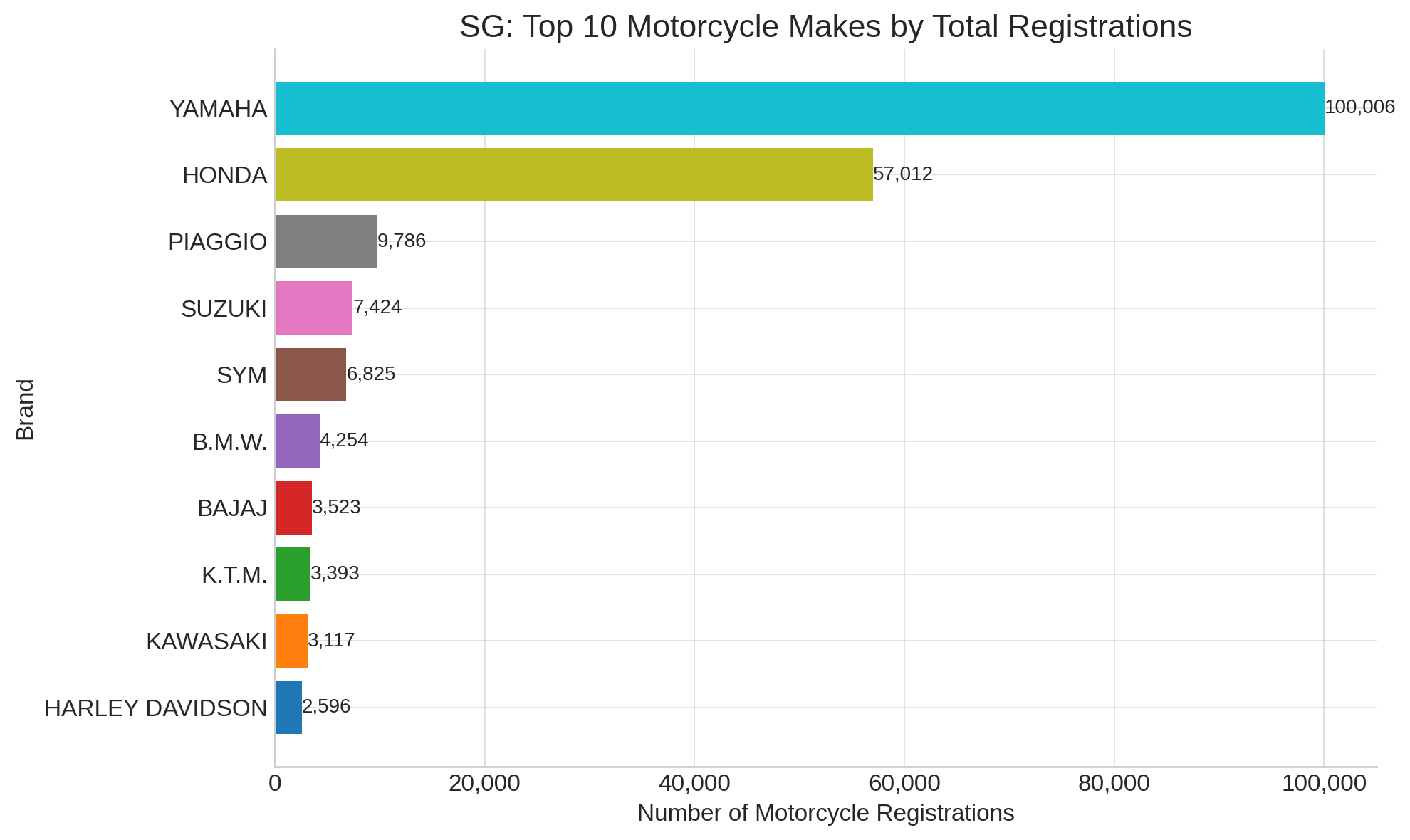

Singapore’s motorcycle market is a fascinating tapestry of brands—yet when you dive into the numbers, a clear hierarchy emerges. Our recent chart of the top 10 makes by cumulative registrations reveals some unsurprising leaders, but also a few surprises at the tail end.

- Yamaha sits comfortably at the top with over 100,000 registrations. Its broad lineup—from commuter bikes to sport machines—has clearly struck a chord with riders seeking value, reliability, and performance.

- In second place, Honda boasts around 57,000 registrations. As with Yamaha, Honda’s extensive local dealer network and reputation for bullet-proof engineering have solidified its position.

- Rounding out the podium is Piaggio, the Italian scooter specialist, with close to 10,000 registrations. This underscores Singapore riders’ love affair with premium scooters—perhaps the Vespa nostalgia plays a part.

Further down the list, Suzuki (7,400) and SYM (6,800) continue to draw commuters with their budget-friendly models and efficient engines. European heavyweight B.M.W. makes an appearance at sixth (4,250), catering to a niche of adventure and touring customers. Meanwhile, “value” marques like Bajaj and K.T.M. occupy spots seven and eight, followed by Kawasaki and Harley-Davidson, whose strong perhaps more lifestyle-oriented appeal still attracts a dedicated, if smaller, following.

Key takeaways:

- Japanese dominance remains unchallenged at the top—Yamaha and Honda together account for nearly 80% of the top-10 registrations.

- Scooter culture is alive and well, with Piaggio and SYM ranking high.

- Niche brands like BMW and Harley-Davidson, while not volume leaders, hold their ground in premium segments.

The chart “SG: Motorcycle Total Registrations by Brand (2005 to 2024)” highlights a broad spectrum of marques beyond the usual leaders, offering insight into both established names and emerging players that occupy the middle-to-lower tiers of Singapore’s two-wheeled market.

At the very top of this subset sits Harley-Davidson, with 2,596 cumulative registrations, underscoring the enduring appeal of its cruiser and touring models even among a niche audience. Close behind is Ducati (2,470) and KYMCO (2,410), the former appealing to performance-oriented riders and the latter dominating the scooter segment with its value-driven, commuter-friendly lineup.

A noticeable drop follows, but still within the thousands: Aprilia (1,797) and Daelim (1,583) reflect strong specialty offerings—Aprilia in sporty middleweights and Daelim in practical, budget-conscious models. Triumph (1,574) and Adiva (885) round out the mid-pack, the former leveraging a retro-modern heritage and the latter solidifying its presence in the urban micro-scooter niche. These numbers illustrate that while mainstream brands understandably capture the lion’s share of volume, there remains ample room for specialist marques to cultivate dedicated followings.

Below the four-digit marks, an even more fragmented landscape emerges. Royal Enfield (690) and P.G.O. (580) demonstrate the power of strong brand identity—vintage styling for Enfield, Taiwanese micro-scooters for P.G.O.—to sustain sales in a crowded marketplace. The long tail of smaller players, including CFMOTO (490), Zongshen (392), Zontes (378), Husqvarna (359), and beyond, highlights a dynamic environment where newcomers can gain traction through competitive pricing, novel styling, or specific performance claims.

- Source of data: https://datamall.lta.gov.sg/content/datamall/en/static-data.html

- SG motorcycle Data Analysis assisted by ChatGPT Advanced Data Analysis. ChatGPT o4-mini-high.